1 Our 2025-2026 budget

Each year, West Sussex County Council approves a budget for the coming financial year at the budget meeting. We do this alongside a 5 year capital programme. These pages will give you information about:

- how we spend money

- where our money comes from

- how it relates to your Council Tax bill

From the Leader of West Sussex County Council

"For the financial year, April 2025 to March 2026, we have agreed to spend more than £2.2 billion on services which support our Council Plan, with the vast majority of this going to schools, social care, recycling and waste disposal, and roads.

We are facing extremely challenging times in terms of local government finances, particularly around social care, special educational needs and disabilities (SEND), and home to school transport, but I’m pleased to say we have been able to close our predicted budget gap and delivered a balanced budget without cuts to front-line services.

Whilst we have balanced the budget for this year, we will still unfortunately be facing increasing financial challenges in the years to come, as the pressures facing the county council outweigh the funding received from government.

We will do all we can to continue to lobby ministers on the need for a national funding solution to meet the local needs of our communities."

Paul Marshall, Leader of West Sussex County Council

For more information from the Leader, see our budget news page.

Supporting documents

You can download and print a document version of these pages.

Setting the budget involves agreeing statutory and discretionary fees and charges. You can find these in the 'Fees and charges schedule' on the budget documents page. This page also has documents showing detailed information for this year and previous years.

2 How we spend our funds

For 2025-2026, the county council has approved planned gross expenditure of £2.2 billion across the following areas:

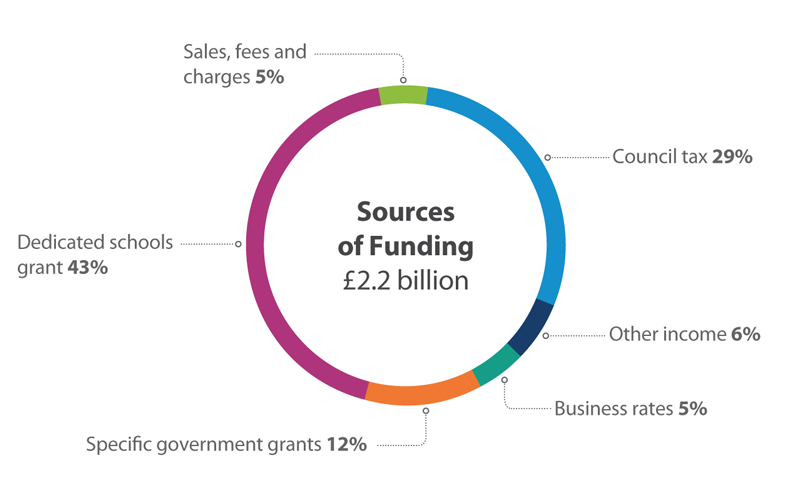

Sources of funding

The money will come from:

How spending has changed since 2024-2025

For details of how the spending for 2025-2026 has changed from 2024-2025, see the 2025-2026 budget book, on the budget documents page.

3 Our capital investment and expenditure

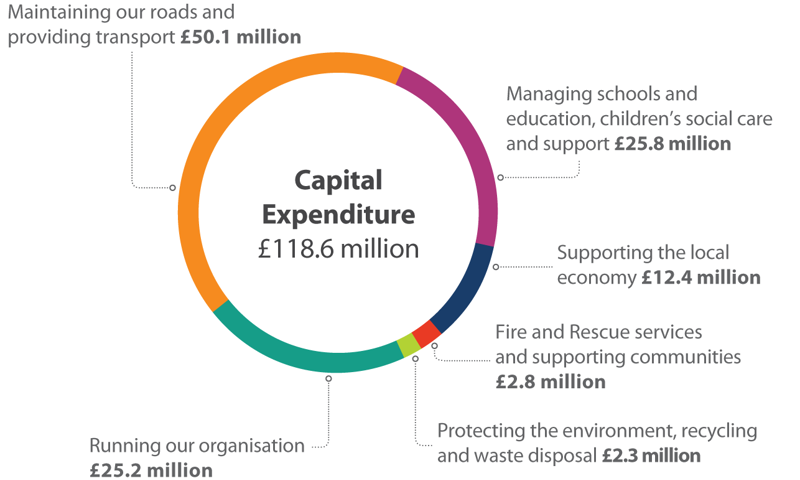

In addition to our £2.2 billion gross expenditure on day-to-day services, the county council has a 5 year capital investment programme for longer term improvements. We expect to spend £118.6 million on planned investment in capital projects for 2025-2026 and £739.9 million over the next 5 years.

This 2025-2026 spend includes:

- £50.1 million in highways and transport reflecting its importance for economic growth

- £25.8 million investment in the county’s schools, early year settings and accommodation to support vulnerable children

- £2.3 million to protect the environment, focussed on investment into:

- renewable energy

- work to lower the carbon footprint of council buildings

- changes needed to waste disposal

The below graph shows the total 2025-2026 capital expenditure. It also shows the allocation of spending between services.

4 Council Tax charges

The West Sussex County Council (WSCC) part of your Council Tax charge will increase by 4.99%. For an average band D household, this increase is about £1.65 per week.

In addition, your bill includes charges for your:

- district or borough council

- Sussex Police and Crime Commissioner

- town or parish council, if applicable.

Details of your full Council Tax charge are in your bill. See paying your Council Tax.

Charges for 2025-2026

The amount of Council Tax you pay depends on your Council Tax band, which is based on the value of your home in 1991. For Council Tax banding queries, contact the Valuation Office Agency.

You can find out your Council Tax band on GOV.UK.

This table shows the county council charges for 2025-2026:

| Valuation band | West Sussex County Council charge |

|---|---|

| A | £1,200.36 |

| B | £1,400.42 |

| C | £1,600.48 |

| D | £1,800.54 |

| E | £2,200.66 |

| F | £2,600.78 |

| G | £3,000.90 |

| H | £3,601.08 |

Presentation of charges

There is a change to the presentation of your charges in your 2025-2026 bill.

Previously, there were 2 parts to your WSCC charge - a core charge and a specific charge for the Adult Social Care Precept. The government introduced the precept to respond to rising demand for adult social care services.

From 2025-2026, the government no longer require these charges to be shown as 2 separate lines on your bill. You will now see your total WSCC charge displayed on one line.

When comparing, this years increase is applied to the overall (both core and precept) charge from last year.

5 Paying your Council Tax

You pay your Council Tax to your district or borough council.

For more information, enter your postcode on our how to pay Council Tax page. This will direct you to your district or borough council's website.

Help to pay your Council Tax

Your district or borough council will also give you information about help to pay Council Tax. This includes discounts and exemptions if they apply.

We offer help, advice and practical support on topics ranging from money management to energy saving. See our pages about the cost of living.

6 Budget documents

The budget book documents below show the full details of our budget with descriptions of spending.

Current documents

Previous budget books

- Budget book 2024-2025 (PDF, 2.6MB)

- Budget book 2023-2024 (PDF, 2MB)

- Budget book 2022-2023 (PDF, 2.6MB)

Previous fees and charges schedules

7 Contact us

Additional information

You can download and print a copy of these pages: